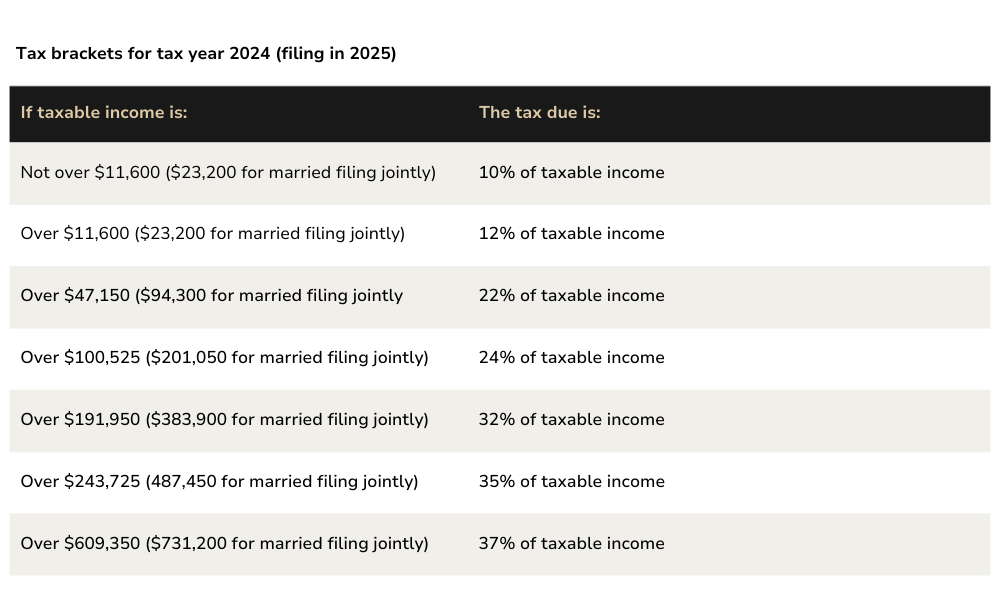

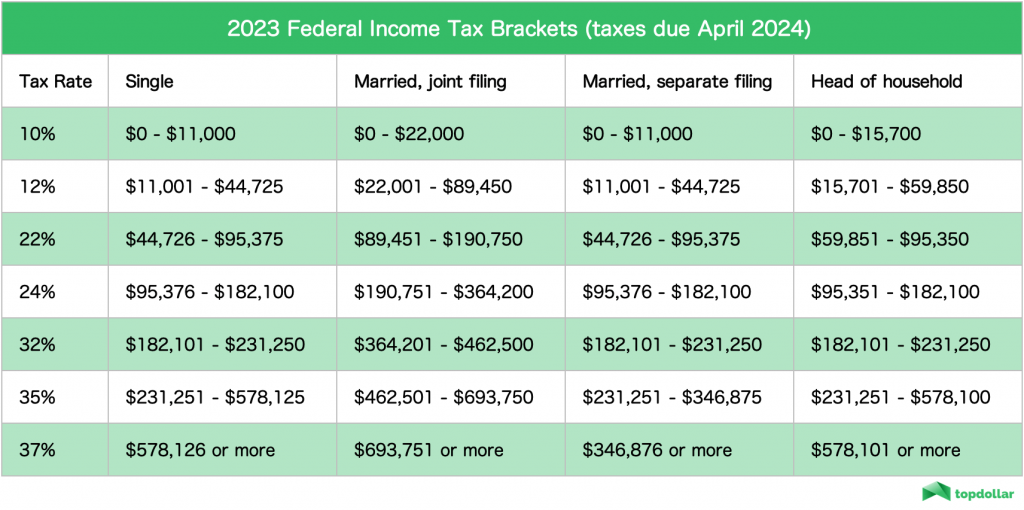

2025 Income Tax Brackets Calculator. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ). In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Use the simple tax calculator to work out just the tax you owe on your taxable income for the full income year. All set to file your taxes?

IRS Sets 2025 Tax Brackets with Inflation Adjustments, In 2025, there are seven federal income tax rates and brackets: Us tax calculator 2025 [for 2025 tax return] this tool is designed to assist with calculations for the 2025 tax return and forecasting for the 2025 tax year.

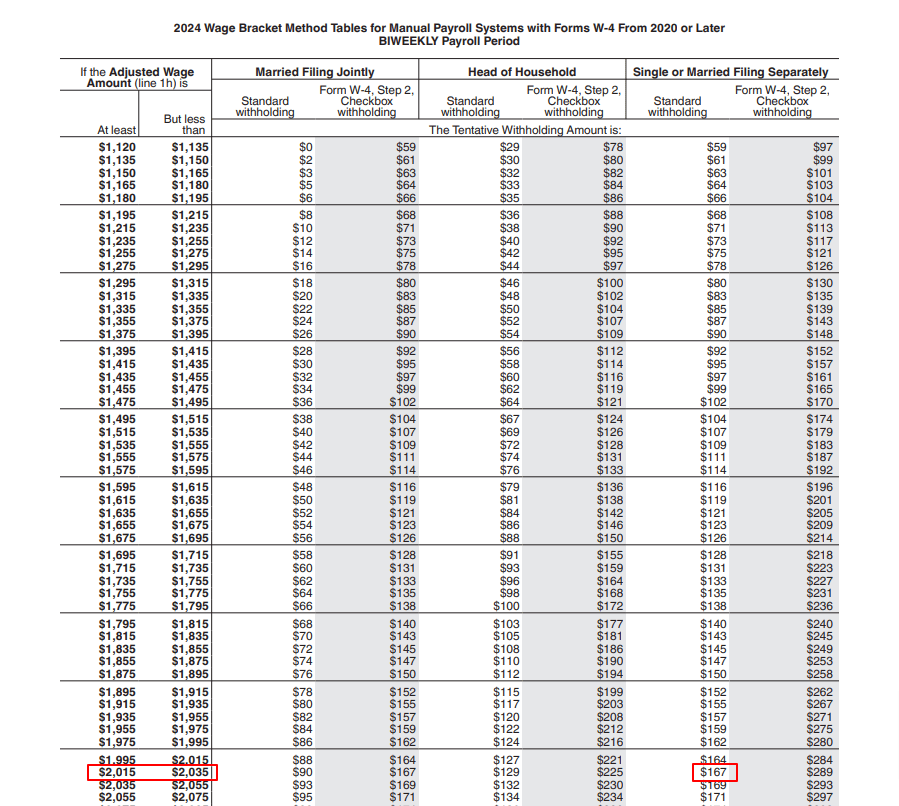

Updated Tax Withholding Tables for 2025 A Guide, Use our us tax brackets calculator in order to discover both your tax liability and your tax rates for the current tax season. Your average tax rate is 10.94%.

Tax rates for the 2025 year of assessment Just One Lap, All set to file your taxes? See current federal tax brackets and rates based on your income and filing status.

2025 Tax Brackets And The New Ideal Financial Samurai, Page last reviewed or updated: The 2025 tax year is the same as the 2025 one, with no changes.

Tax rates for the 2025 year of assessment Just One Lap, The income tax calculator estimates the refund or potential owed amount on a federal tax return. In 2025, for example, if you're single earning $11,601 to $47,150, you're in the 12% tax bracket, which means your tax rate is 12% on income within that range.

Tax Brackets 2025 Single Nelia, Receiving arrears may elevate your tax burden by moving you into a higher tax bracket. Use our us tax brackets calculator in order to discover both your tax liability and your tax rates for the current tax season.

IRS announces new tax brackets for 2025, You only pay 10% on your first. How much of your income falls within each tax.

2025 Federal Tax Brackets, Your taxable income is your income after various deductions, credits, and exemptions have been applied. Australian residents tax rates 2025 to 2025.

Tax Brackets 2025 Calculator Texas Audi Marena, Australian residents tax rates 2025 to 2025. How much of your income falls within each tax.

IRS Announces New 2025 Tax Brackets Queen Financial Services, In 2025, for example, if you're single earning $11,601 to $47,150, you're in the 12% tax bracket, which means your tax rate is 12% on income within that range. These rates apply to your taxable income.

Use the simple tax calculator to work out just the tax you owe on your taxable income for the full income year.