Tax Brackets 2025 Canada Calculator. Information on income tax rates in canada including federal rates and those rates specific to provinces and territories. Incomes within the $57,375 or less tax bracket will be taxed at 15 per cent;

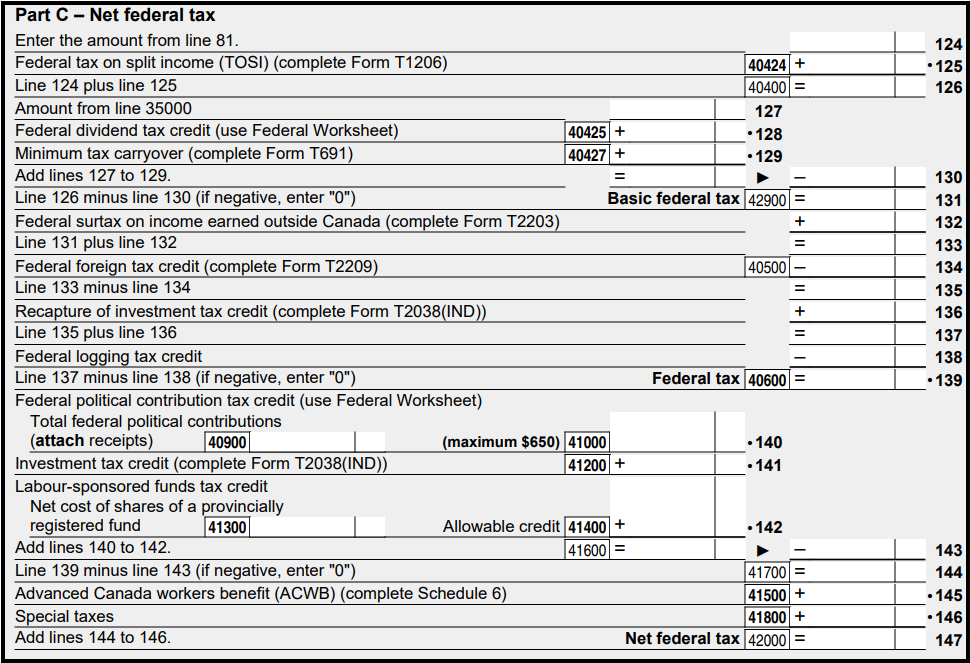

The federal tax brackets and personal tax credit amounts are increased for 2025 by an indexation factor of 1.027 (2.7% increase). The canada revenue agency (cra) adjusts federal tax brackets annually to account for inflation, ensuring a fair taxation system.

Tax Calculator 2025 Washington State Truda Hilliary, Select your province or territory below to calculate your personal income taxes.

Tax Brackets 2025 Canada Calculator Nelia Octavia, Select your province or territory below to calculate your personal income taxes.

Tax Brackets 2025 Calculator Canada Gnni Roseanna, Incomes between the $57,375.01 to $114,750 tax.

Tax Brackets 2025 Calculator Canada Gnni Roseanna, 2025 and 2025 cwb amounts are based on 2025 amounts indexed for inflation.

Tax Brackets 2025 Canada Calculator Nelia Octavia, Calculate your annual federal and provincial combined tax rate with our easy online tool.

Tax Brackets 2025 Calculator Canada Gnni Roseanna, The canada revenue agency (cra) has released the federal income tax brackets for 2025, and there are a few things you'll want to know about how these changes.

2025 Tax Brackets Canada Fanni Jeannie, Calculate your annual federal and provincial combined tax rate with our easy online tool.

New Years Eve Events 2025 New York. The statue of liberty offers a unique and scenic way to celebrate new[...]

Jan 2025 Calendar Daily Sheet Free Download. You can find the monthly and daily sheets of january 2025 tamil calendar[...]

Minimum Wage In California 2025 $20 Gold. 1, california’s minimum wage will increase to $16.50. California state minimum wage for[...]